8.3 Health Care Funding

Open Resources for Nursing (Open RN)

Health care costs impact both macroeconomics (affecting the entire country and society as a whole) and microeconomics (affecting the financial decisions of businesses and individuals). Health care services are funded by several payment models, including federal government programs (e.g., Medicare and Medicaid), private health insurance (typically provided by employers), and self-pay. Payment models also impact services provided by health care agencies, as well as the services and medications available to consumers. Nurses must be aware of these payment models because of the impact on the allocation of resources they need to provide patient care.

Government Funding

Medicare and Medicaid were signed into law in 1965. These programs provide eligible Americans support for their health care needs with taxpayer funding.

Medicare

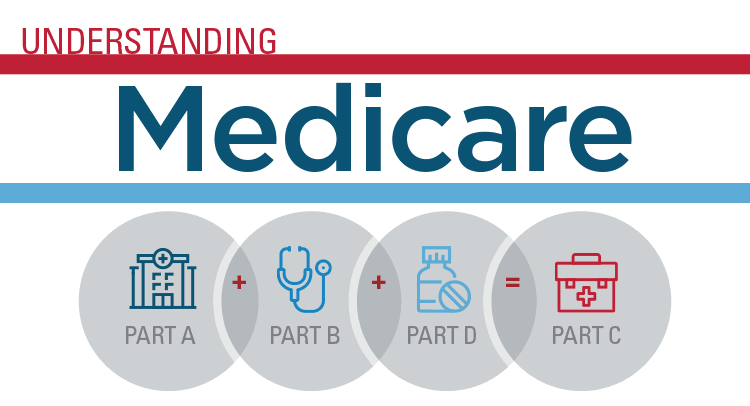

Medicare is a federal health insurance program used by people aged 65 and older, younger individuals with permanent disabilities, and people with end-stage renal disease requiring dialysis or kidney transplantation. Medicare coverage has four possible components: Part A, Part B, Part C, and Part D.[1] See Figure 8.5[2] for an infographic illustrating Medicare Parts A, B, C, and D.

- Part A (Hospital Insurance): Part A covers patients’ hospital stays, skilled nursing facility care, hospice care, and some home health care. Part A is free for clients if they or their spouse paid Medicare taxes for a specific amount of time while working. If clients are not eligible for free coverage, they can buy it with premiums based on the number of months they paid Medicare taxes.

- Part B (Medical Insurance): Part B covers doctors’ services, outpatient care, medical supplies, and preventative care services. Most people pay a standard premium for Part B.

- Part C (Medicare Advantage Plan): A Medicare Advantage Plan is a health plan choice offered by private companies approved by Medicare, also referred to as “Part C.” These plans provide Part A and Part B coverage, and most also include Part D coverage. Medicare Advantage Plans may offer extra coverage, such as vision, hearing, dental, and/or health and wellness programs.

- Part D (Prescription Drug Coverage): Part D helps cover the cost of prescription drugs and vaccinations. To get Medicare drug coverage, clients must enroll in a Medicare-approved plan that offers drug coverage. Different plans vary in cost and what prescription medications they cover, also referred to as a formulary.

Read more about Medicare at medicare.gov.

Medicaid

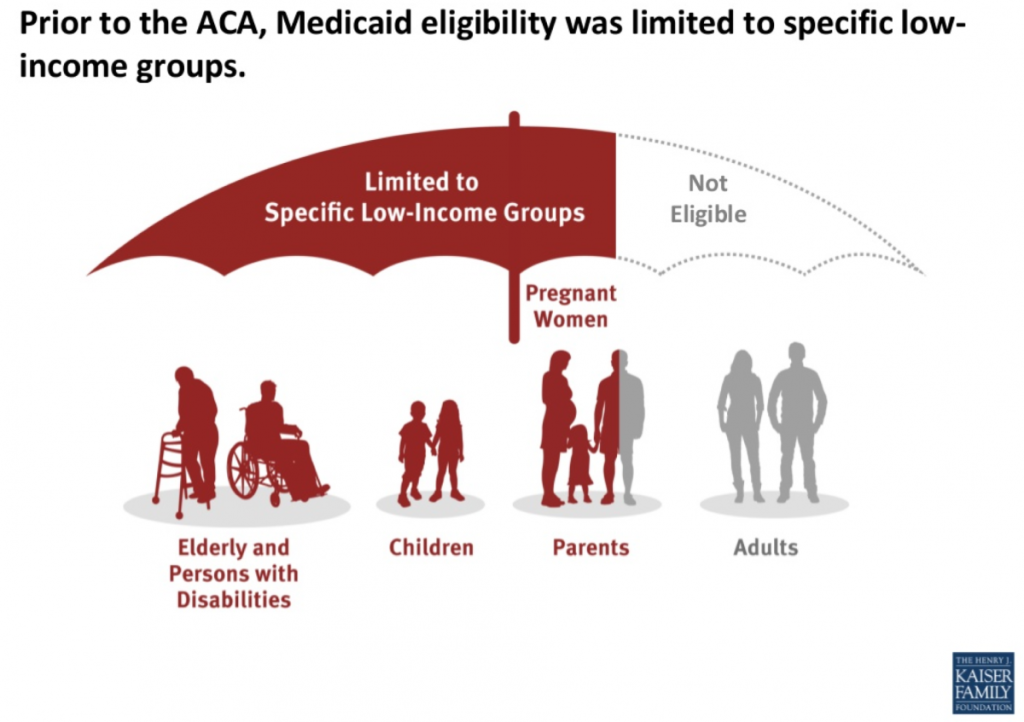

Medicaid is the largest source of health coverage in the United States. It is a joint federal and state program covering eligible individuals with taxpayer funding. To participate in Medicaid, federal law requires states to cover certain groups of individuals, such as low-income families, qualified pregnant women and children, and individuals receiving Supplemental Security Income (SSI). States may choose to cover additional groups, such as individuals receiving home and community-based services and children in foster care who are not otherwise eligible.[3]

In 2014 the Affordable Care Act expanded Medicaid to cover all low-income Americans under the age of 65 years and also expanded coverage for children. Due to the individual states’ involvement in Medicaid, coverage of services varies from state to state.[4] See Figure 8.6[5] for an illustration of Medicaid-eligible populations.

Individuals with Medicaid plans have support in paying for a variety of health services, including hospital care, laboratory and diagnostic testing, skilled nursing care, home health services, preventative care, and regular outpatient provider visits.

Other Government Health Funding

There are several other types of health coverage provided by federal and state programs. Read more about these programs in the following box.

Other Federal and State Health Care Funding Programs[6]

- State Children’s Health Insurance Program (CHIP): A program designed to help provide coverage for uninsured children whose family income is below average but too high to qualify for Medicaid. The federal government provides matching funds to states for health insurance for these families.

Read more details at InsuredKidsNow.gov.

- Children and Youth With Special Health Care Needs: This program coordinates funding and resources to provide care to people with special health needs.

Read more details at Children With Special Health Care Needs.

- Tricare: This program covers about 9 million active duty and retired military personnel and their families.

Read more details at TRICARE.

- Veterans Health Administration (VHA): This government-operated health care system provides comprehensive health services to eligible military veterans. About 9 million veterans are enrolled.

Read more details at Veterans Health Administration.

- Indian Health Service: This system of government hospitals and clinics provides health services to about 2 million Native Americans living on or near a reservation.

Read more details at Indian Health Service.

- Federal Employee Health Benefits (FEHB) Program: This program allows private insurers to offer insurance plans within guidelines set by the government for the benefit of active and retired federal employees and their survivors.

Read more details at The Federal Employees Health Benefits (FEHB) Program.

- Refugee Health Promotion Program: This program provides short-term health insurance to newly arrived refugees.

Read more details at Refugee Health Promotion Program (RHP).

Private Insurance

Individuals who are not eligible for government-funded health programs like Medicare or Medicaid can purchase private health insurance. Many individuals with private insurance obtain coverage through their employers’ benefit packages, where the costs for coverage are shared between the employer and the employee. If an individual does not receive health insurance through their employer, they may purchase it from the Marketplace established by the Affordable Care Act.

Read more about obtaining health insurance through the ACA Marketplace at healthcare.gov.

Self-Pay

Some individuals do not have health care coverage provided by their employer, do not qualify for Medicare or Medicaid, and do not elect to purchase health insurance coverage. Instead, these individuals go without coverage and pay health care costs as they arise. See Figure 8.7[7] for a graph illustrating the decreasing numbers of uninsured consumers in the United States over the past several decades. Unfortunately, due to the skyrocketing cost of health care services, significant bills can accrue from a single serious illness or traumatic injury that can put consumers without health care coverage in jeopardy of bankruptcy. Nurses can assist uninsured individuals to better understand coverage options by referring them to a case manager or social worker.

Types of Insurance Coverage

Health insurance plans have different types of coverage. Common types of health insurance plans are HMO, PPO, POS, HDHP, or HSA.

- Health Maintenance Organization (HMO): HMO plans usually have the lowest monthly cost for coverage (i.e., premium) but also have a smaller network of providers and hospitals where the consumer may receive insured care. This means the consumer is restricted to receive care only from specific providers and health facilities. Many HMOs also require the consumer to see their primary care provider to request a referral to see a specialist, which may or may not be approved by the HMO. Additionally, many tests, procedures, surgeries, and medications require “preauthorization” by the HMO, which may or may not be approved. Due to these restrictions, consumers may find they sacrifice flexibility and choice for lower cost of coverage.[8]

- Preferred Provider Organization (PPO): PPO plans are typically less restrictive than HMOs. PPOs typically include “in-network” providers and hospitals where costs are lower if care is received in-network, but consumers also have a choice to receive “out-of-network” care at a higher cost. Referrals from a primary care provider are not generally required in a PPO. The monthly premium for a PPO plan is typically higher than an HMO plan, but PPOs allow more consumer flexibility in choosing their health care providers.[9]

- Point of Service (POS): POS plans are a combination of HMO and PPO plans, where the insured consumer has a preferred provider network to receive health care services at a lower cost, but also has the flexibility to receive care outside of their network. When consumers venture outside of the network, they often have to pay a significant share of the cost.[10]

- High Deductible Health Plan (HDHP): HDHP plans are often popular for younger individuals without chronic health care needs who spend little on health care but require coverage in the event a high-cost injury or illness occurs. HDHPs typically have lower monthly premiums but require the individual to pay more upfront for health care services before the coverage kicks in (referred to as a “deductible”). Individuals with an HDHP often have an associated Health Savings Account (HSA). HDHPs have grown in popularity as more employers offer these plans in an attempt to contain health care costs by shifting more cost-sharing to the consumer.

- Health Savings Account (HSA): An HSA is a special account reserved for eligible medical expenses with strict usage rules. Money placed in an HSA can often be deducted from a consumer’s pretaxed pay, resulting in tax savings. In addition to purchasing items like glasses, contacts, and over-the-counter medications, HSAs can often be used to pay for deductibles. Some employers deposit a specified amount of money into an employee’s HSA every year to help reimburse high deductibles.

Deductible and Copays

Costs paid by an insured individual are commonly referred to as “out-of-pocket expenses.” Out-of-pocket expenses include deductibles and co-pays. A deductible is the amount of money a consumer pays before the health care plan pays anything. Deductibles generally apply per person per calendar year. Typically, a PPO has higher premiums but lower deductibles than a HDHP.

A co-pay is a flat fee the consumer pays at the time of the health care service. For example, when visiting a primary provider, the consumer may pay $20 to the provider at each visit as a co-pay. Some health care plans require co-pays in addition to deductibles.

Nursing Considerations

Understanding a client’s health insurance coverage is important because it may impact their choice of health services and their ability to purchase medications and other supplies. Additionally, if a client is self-pay, it is helpful to refer them to resources such as case managers, social workers, or the financial department of the agency. These resources can assist them in obtaining affordable health care coverage through the ACA Marketplace or other government programs.

Media Attributions

- Understanding_of_medicare

- Medicaid.expansion-1200×846

- 1280px-Percentage_of_persons_without_health_insurance_in_the_US,_OWID.svg

- Medicare.gov. What’s Medicare? https://www.medicare.gov/what-medicare-covers/your-medicare-coverage-choices/whats-medicare ↵

- “Understanding_of_medicare.png” by Samreen Al is licensed under CC BY-SA 4.0 ↵

- Medicaid.gov. Eligibility. https://www.medicaid.gov/medicaid/eligibility/index.html ↵

- Healthcare.gov. Affordable Care Act. https://www.healthcare.gov/glossary/affordable-care-act/ ↵

- “Medicaid.expansion-1200x846.png” by KFF is licensed under CC BY-NC-ND 4.0 ↵

- Schreck, R. I. (2020, March). Overview of health care financing. Merck Manual Consumer Version. https://www.merckmanuals.com/home/fundamentals/financial-issues-in-health-care/overview-of-health-care-financing ↵

- “Percentage_of_persons_without_health_insurance_in_the_US,_OWID.svg” by Our World In Data is licensed under CC BY 3.0 ↵

- Small Business Majority. Coverage types. https://healthcoverageguide.org/reference-guide/coverage-types/ ↵

- Small Business Majority. Coverage types. https://healthcoverageguide.org/reference-guide/coverage-types/ ↵

- Small Business Majority. Coverage types. https://healthcoverageguide.org/reference-guide/coverage-types/ ↵

This textbook discusses professional and management concepts related to the role of a registered nurse (RN) as defined by the American Nurses Association (ANA). The ANA publishes two resources that set standards and guide professional nursing practice in the United States: The Code of Ethics for Nurses With Interpretive Statements and Nursing: Scope and Standards of Practice. The Code of Ethics for Nurses With Interpretive Statements establishes an ethical framework for nursing practice across all roles, levels, and settings and is discussed in greater detail in the “Ethical Practice” chapter of this book. The Nursing: Scope and Standards of Practice resource defines the “who, what, where, when, why, and how of nursing” and sets the standards for practice that all registered nurses are expected to perform competently.[1]

The ANA defines the “who” of nursing practice as the nurses who have been educated, titled, and maintain active licensure to practice nursing. The “what” of nursing is the recently revised ANA definition of nursing: “Nursing integrates the art and science of caring and focuses on the protection, promotion, and optimization of health and human functioning; prevention of illness and injury; facilitation of healing; and alleviation of suffering through compassionate presence. Nursing is the diagnosis and treatment of human responses and advocacy in the care of individuals, families, groups, communities, and populations in recognition of the connection of all humanity.”[2] Simply put, nurses treat human responses to health problems and life processes and advocate for the care of others.

Nursing practice occurs “when'' there is a need for nursing knowledge, wisdom, caring, leadership, practice, or education, anytime, anywhere. Nursing practice occurs in any environment “where'' there is a health care consumer in need of care, information, or advocacy. The “why” of nursing practice is described as nursing’s response to the changing needs of society to achieve positive health care consumer outcomes in keeping with nursing’s social contract and obligation to society. The “how” of nursing practice is defined as the ways, means, methods, and manners that nurses use to practice professionally.[3] The “how” of nursing, also referred to as a nurse’s “scope and standards of practice,” is further defined by each state’s Nurse Practice Act; agency policies, procedures, and protocols; and federal regulations and ANA’s Standards of Practice.

State Boards of Nursing and Nurse Practice Acts

RNs must legally follow regulations set by the Nurse Practice Act by the state in which they are caring for patients with their nursing license. The Board of Nursing is the state-specific licensing and regulatory body that sets standards for safe nursing care and issues nursing licenses to qualified candidates based on the Nurse Practice Act. The Nurse Practice Act is enacted by that state’s legislature and defines the scope of nursing practice and establishes regulations for nursing practice within that state. If nurses do not follow the standards and scope of practice set forth by the Nurse Practice Act, they may be disciplined by the Board of Nursing in the form of reprimand, probation, suspension, or revocation of their nursing license. Investigations and discipline actions are reportable among states participating in the Nurse Licensure Compact (that allows nurses to practice across state lines) or when a nurse applies for licensure in a different state. The scope and standards of practice set forth in the Nurse Practice Act can also be used as evidence if a nurse is sued for malpractice.

Find your state's Nurse Practice Act on the National Council of State Board of Nursing (NCSBN) website.

Read more about malpractice and protecting your nursing license in the “Legal Implications” chapter of this book.

Read Wisconsin’s Nurse Practice Act, Standards of Practice for Registered Nurses and Licensed Practical Nurses (Chapter N6) PDF, and Rules of Conduct (Chapter N7) PDF.

Agency Policies, Procedures, and Protocols

In addition to practicing according to the Nurse Practice Act in the state they are employed, nurses must also practice according to agency policies, procedures, and protocols.

A policy is an expected course of action set by an agency. For example, hospitals set a policy requiring a thorough skin assessment to be completed when a patient is admitted and then reassessed and documented daily.

Agencies also establish their own set of procedures. A procedure is the method or defined steps for completing a task. For example, each agency has specific procedural steps for inserting a urinary catheter.

A protocol is a detailed, written plan for performing a regimen of therapy. For example, agencies typically establish a hypoglycemia protocol that nurses can independently and quickly implement when a patient’s blood sugar falls below a specific number without first calling a provider. A hypoglycemia protocol typically includes actions such as providing orange juice and rechecking the blood sugar and then reporting the incident to the provider.

Agency-specific policies, procedures, and protocols supersede the information taught in nursing school, and nurses can be held legally liable if they don’t follow them. It is vital for nurses to review and follow current agency-specific procedures, policies, and protocols while also practicing according to that state's nursing scope of practice. Malpractice cases have occurred when a nurse was asked by their employer to do something outside their legal scope of practice, impacting their nursing license. It is up to you to protect your nursing license and follow the Nurse Practice Act when providing patient care. If you have a concern about an agency’s policy, procedure, or protocol, follow the agency’s chain of command to report your concern.

Federal Regulations

Nursing practice is impacted by regulations enacted by federal agencies. Two examples of federal agencies setting standards of care are The Joint Commission and the Centers for Medicare and Medicaid Services.

The Joint Commission accredits and certifies over 20,000 health care organizations in the United States. The Joint Commission’s standards help health care organizations measure, assess, and improve performance on functions that are essential to providing safe, high-quality care. The standards are updated regularly to reflect the rapid advances in health care and address topics such as patient rights and education, infection control, medication management, and prevention of medical errors. The annual National Patient Safety Goals are also set by The Joint Commission after reviewing emerging patient safety issues.[4]

The Centers for Medicare & Medicaid Services (CMS) is an example of another federal agency that establishes regulations affecting nursing care. CMS is a part of the U.S. Department of Health and Human Services (HHS) that administers the Medicare program and works in partnership with state governments to administer Medicaid. The CMS establishes and enforces regulations to protect patient safety in hospitals that receive Medicare and Medicaid funding. For example, one CMS regulation often referred to as “checking the rights of medication administration” requires nurses to confirm specific information several times before medication is administered to a patient.[5]

Standards of Practice

The ANA defines Standards of Professional Nursing Practice as “authoritative statements of the actions and behaviors that all registered nurses, regardless of role, population, specialty, and setting, are expected to perform competently.”[6] These standards are classified into two categories: Standards of Practice and Standards of Professional Performance.

The ANA’s Standards of Practice describe a competent level of nursing practice as demonstrated by the critical thinking model known as the nursing process. The nursing process includes the components of assessment, diagnosis, outcomes identification, planning, implementation, and evaluation and forms the foundation of the nurse’s decision-making, practice, and provision of care.[7]

Read more information about the nursing process in the “Nursing Process” chapter of Open RN Nursing Fundamentals, 2e.[8]

The ANA’s Standards of Professional Performance “describe a competent level of behavior in the professional role, including activities related to ethics, advocacy, respectful and equitable practice, communication, collaboration, leadership, education, scholarly inquiry, quality of practice, professional practice evaluation, resource stewardship, and environmental health. All registered nurses are expected to engage in professional role activities, including leadership, reflective of their education, position, and role.”[9] This book discusses content related to these professional practice standards. Each professional practice standard is defined in the following sections with information provided to related content in this book and the Open RN Nursing Fundamentals, 2e textbook.[10]

Ethics

The ANA’s Ethics standard states, “The registered nurse integrates ethics in all aspects of practice.”[11]

Read about ethical nursing practice in the “Ethical Practice” chapter of this book.

Advocacy

The ANA’s Advocacy standard states, “The registered nurse demonstrates advocacy in all roles and settings.”[12]

Read about nurse advocacy in the “Advocacy” chapter of this book.

Respectful and Equitable Practice

The ANA’s Respectful and Equitable Practice standard states, “The registered nurse practices with cultural humility and inclusiveness.”

Read about cultural humility and culturally responsive care in the “Diverse Patients” chapter in Open RN Nursing Fundamentals, 2e.[13]

Communication

The ANA’s Communication standard states, “The registered nurse communicates effectively in all areas of professional practice.”[14]

Read about communicating with clients and team members in the “Communication” chapter in Open RN Nursing Fundamentals, 2e.[15]

Read about interprofessional communication strategies that promote patient safety in the “Collaboration Within the Interprofessional Team” chapter of this book.

Collaboration

The ANA’s Collaboration standard states, “The registered nurse collaborates with the health care consumer and other key stakeholders.”[16]

Read about strategies to enhance the performance of the interprofessional team and manage conflict in the “Collaboration Within the Interprofessional Team” chapter of this book.

Leadership

The ANA’s Leadership standard states, “The registered nurse leads within the profession and practice setting.”[17]

Read about leadership, management, and implementing change in the “Leadership and Management” chapter of this book.

Read about assigning, delegating, and supervising patient care in the “Delegation and Supervision” chapter of this book.

Read about tools for prioritizing patient care and managing resources for the nursing team in the “Prioritization” chapter of this book.

Education

The ANA’s Education standard states, “The registered nurse seeks knowledge and competence that reflects current nursing practice and promotes futuristic thinking.”[18]

Read about professional development and specialty certification in the “Preparation for the RN Role” chapter of this book.

Scholarly Inquiry

The ANA’s Scholarly Inquiry standard states, “The registered nurse integrates scholarship, evidence, and research findings into practice.”[19]

Read about integrating evidence-based practice into one’s nursing practice in the “Quality and Evidence-Based Practice” chapter of this book.

Quality of Practice

The ANA’s Quality of Practice standard states, “The nurse contributes to quality nursing practice.”[20]

Read about improving quality patient care and participating in quality improvement initiatives in the “Quality and Evidence-Based Practice” chapter of this book.

Professional Practice Evaluation

The ANA’s Professional Practice Evaluation standard states, “The registered nurse evaluates one’s own and others’ nursing practice.”[21]

Read about nursing practice within the legal framework of health care, negligence, malpractice, and protecting your nursing license in the “Legal Implications” chapter of this book.

Read about reviewing the interprofessional team’s performance, providing constructive feedback, and advocating for patient safety with assertive statements in the “Collaboration Within the Interprofessional Team” chapter of this book.

Resource Stewardship

The ANA’s Resource Stewardship standard states, “The registered nurse utilizes appropriate resources to plan, provide, and sustain evidence-based nursing services that are safe, effective, financially responsible, and used judiciously.”[22]

Read more about health care funding, reimbursement models, budgets and staffing, and resource stewardship in the “Health Care Economics” chapter of this book.

Environmental Health

The ANA’s Environmental Health standard states, “The registered nurse practices in a manner that advances environmental safety and health.”[23]

Read about promoting workplace safety for nurses in the “Safety” chapter in Open RN Nursing Fundamentals, 2e.[24]

Read about fostering a professional environment that does not tolerate abusive behaviors in the “Collaboration Within the Interprofessional Team” chapter of this book.

Read about addressing the impacts of social determinants of health in the “Advocacy” chapter of this book.